Introduction

Gcash APK is the official Android app for a popular mobile wallet and financial services platform in the Philippines. Available for free on the Google Play Store, the app offers a variety of features designed to simplify financial transactions, such as transferring money, paying bills, and shopping online. The latest version of the app offers enhanced security, faster processing times, and an improved user interface, making it easier for Android users to manage their finances on the go. With a seamless design and powerful functionality, the app allows users to access banking services, invest in stocks, buy insurance, and even take out loans—all from their mobile devices. Regular updates ensure that users always have access to the latest features and improvements, making the app an indispensable tool for anyone who wants to take full control of their financial lives.

Discover the Best Features of Gcash APK for Effortless Mobile Banking

In today’s fast-paced digital world, mobile banking has become an essential part of our daily lives. You are sending money, paying bills, or shopping online, having a seamless and secure platform to manage your finances is essential. With a variety of features and regular updates, Gcash APK allows users to handle almost every aspect of their financial needs right from the palm of their hand.

Instant Money Transfers, Send and Receive Money Easily

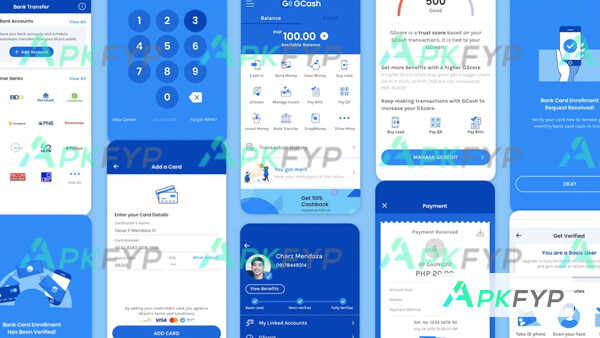

One of the most popular features of the app is the ability to transfer money instantly. You are sending money to friends, family, or paying a supplier, the process is seamless and fast. With free money transfers, it is an ideal solution for anyone looking for a quick and cost-effective way to transfer money. Additionally, the app allows you to send money to non-app users by simply entering their bank account information, making it a versatile tool for both personal and business purposes.

Pay bills with ease

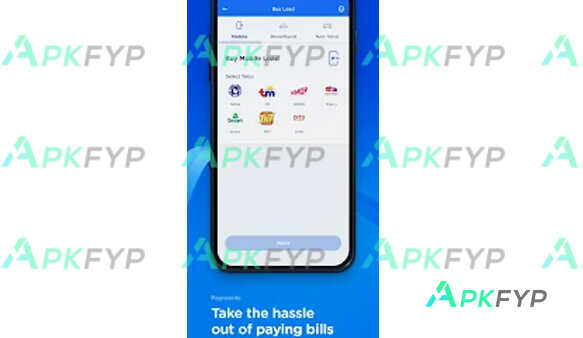

Paying bills is no longer a hassle, thanks to the in-game bill payment feature. The app supports over 400 payment providers, including utilities, insurance companies, credit cards, and even government agencies. Users can pay bills anytime, anywhere, helping them avoid long queues at payment centers. Furthermore, you can set payment reminders for recurring bills, ensuring that you never miss a due date again. The app even allows you to pay bills with GCredit, giving you the flexibility to pay even when you are short on cash.

Safe and Easy Online Shopping

With the rise of online shopping, the app has evolved to make e-commerce easier and safer. The app allows you to pay online instantly when making purchases on various e-commerce platforms, such as Lazada, Shopee, and others. When shopping with the app, users are also insured up to PHP 20,000 in case of online fraud, adding an extra layer of protection when you shop. The app’s QR code feature makes it easy to pay at physical stores and also supports Alipay+ QR for international merchants, ensuring your shopping experience is smooth, safe, and fast.

Protected with Security Features

Security is a top priority for the app and the app integrates multiple layers of protection to keep your personal and financial information safe. Features like 2FA two-factor authentication, biometric login with facial recognition or fingerprint, and real-time transaction alerts ensure that users can trust the platform with their money. Additionally, the app offers fraud protection for online shoppers, giving you peace of mind with up to ₱15,000 insurance. With the app, you can enjoy a worry-free financial experience as your information is secure.

Experience the Power of Simplicity with Gcash APK’s Intuitive Design

In today’s fast-paced digital world, simplicity is often the key to success, especially when it comes to financial apps. Gcash APK, one of the most widely used mobile wallet apps in the Philippines, excels in this area by providing a user-friendly interface that allows people of all ages and tech-savvy to easily navigate and manage their finances. From mobile payments and money transfers to paying bills and even investing, the app simplifies complex tasks, making financial management accessible to everyone.

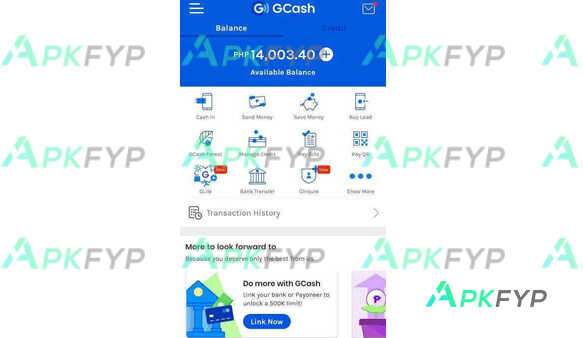

- A Clean and Organized Home Screen: One of the key features of the app’s interface is its clean, uncluttered home screen. As soon as you open the app, you’ll notice a simple layout that prioritizes user experience. The home screen displays all the essential functions like Deposit, Pay Bills, and Purchases in a clearly labeled, easy-to-find manner. The design minimizes clutter, allowing users to access their most frequent tasks with just one tap. This streamlined approach ensures that you don’t have to sift through menus or deal with unnecessary distractions, making the experience comfortable and efficient.

- Easy Navigation with Minimalist Icons: The app’s design philosophy revolves around minimalism. Each feature is represented by intuitive icons, making the interface easy to understand at first glance. Whether it’s depositing funds, checking balances, or accessing investment options, the icons used are easily recognizable. This ensures that new users can quickly adapt to the app, even if they are not exactly tech-savvy. The app icons are large and clear, designed with a vibrant color palette that guides users without overwhelming them.

- Streamlined Payment Process: The app simplifies the payment process by making it as quick and easy as possible. You are paying a bill, making a purchase, or transferring money, the steps are simple and require minimal input. For example, when paying a bill, all you need to do is select a biller, enter the amount, and confirm the transaction. The app automatically saves your payment history and recurring bills, allowing you to set reminders for future payments. This level of simplicity ensures that users can complete financial tasks quickly, without worrying about complicated procedures or excessive steps.

- Clear, Step-by-Step Guidance for New Users: For those new to digital wallets or mobile banking, the app offers a step-by-step guide to help users get started. When you first launch the app, you’ll be given a brief tutorial on how to use the core features. The tutorial is simple and easy to follow, ensuring that even the most tech-averse users can quickly get up to speed with the platform.

Gcash APK: Exploring the Advantages and Disadvantages of This Mobile Wallet

In recent years, e-wallets have become an essential part of everyday life, and Gcash APK has established itself as one of the most popular and widely used digital payment platforms in the Philippines. With the app, users can send money, pay bills, make purchases, shop online, and even invest—all from their smartphones. But, like any app, it has its pros and cons.

Outstanding advantages of the application

The app offers a number of benefits, making it one of the most popular mobile wallets in the Philippines. Convenience is one of its standout features, as users can access a variety of financial services right from their smartphones. You’re sending money, paying bills, making mobile purchases, or shopping online, everything is streamlined into a simple, user-friendly interface. The ability to pay bills for over 400 payment processors and purchase prepaid products like broadband and health insurance further adds to the app’s appeal. Another notable advantage is the security measures the app offers, including biometric authentication and real-time transaction alerts, ensuring that your money and personal information are protected. The app also provides easy access to loans and investment products, such as GCredit, GLoan and GSave, giving users financial flexibility and growth options.

Disadvantages that users need to consider

Despite its many benefits, the app also has some drawbacks that users should be aware of. A common concern is its reliance on the internet – the app requires a stable internet connection to make transactions, which can be a challenge in areas with poor or unstable connectivity. While the app’s basic services are free, some features – such as withdrawing funds to a physical bank account or using GCredit – may incur fees or higher interest rates. Another drawback is that the app’s customer support can sometimes be slow or difficult to reach, especially during peak hours when the platform is experiencing high traffic. Additionally, while the app offers a wide range of services, it is still limited compared to traditional banks, especially for more complex financial needs, such as large business loans or investment portfolios.

Conclusion

In conclusion, Gcash APK is an app that continues to stand out as one of the most comprehensive mobile wallet solutions in the Philippines. With the latest version offering a more user-friendly interface, the app is designed to meet the needs of a wide range of users, from everyday consumers to business owners. You are on the go or managing your finances at home, the app offers unparalleled convenience, making it a must-have for modern mobile banking. With security features like biometric authentication and real-time transaction alerts, the latest version of the app offers a secure, efficient, and seamless financial experience. The free download allows anyone with an Android device to easily access a variety of financial services, including money transfers, bill payments, shopping, and even investing.

FAQs

Is Gcash Mod APK free to use?

+

Yes, Gcash Mod APK is free to use. However, some services such as money transfers or bill payments may have fees associated.

Is Gcash Mod APK safe to use?

+

Yes, Gcash Mod APK uses encryption and secure authentication methods to protect user data and transactions, making it a safe platform for money management.

Can I use Gcash Mod APK without an internet connection?

+

No, Gcash Mod APK requires an internet connection to make transactions and access its services as it is an online platform.

Can I withdraw money from Gcash Mod APK?

+

Yes, you can withdraw money from your Gcash Mod APK account at authorized partner stores, ATMs or transfer money to your linked bank account.