RBI Exchange Screenshot

FAQs

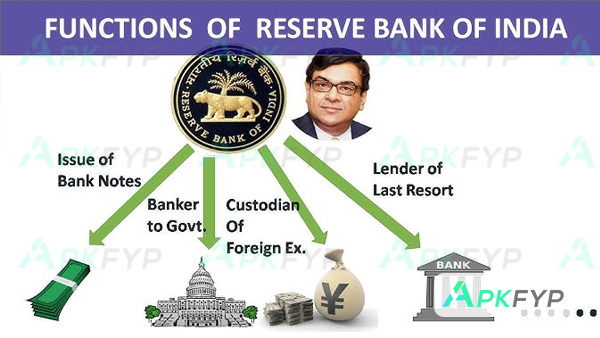

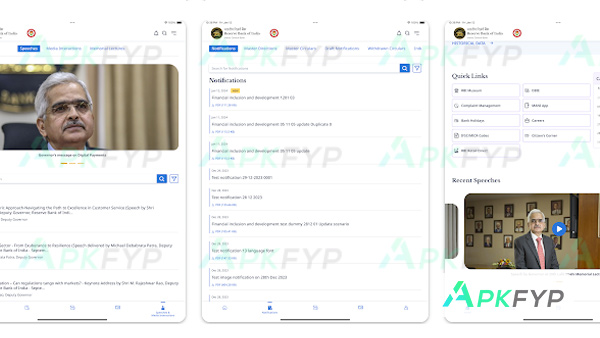

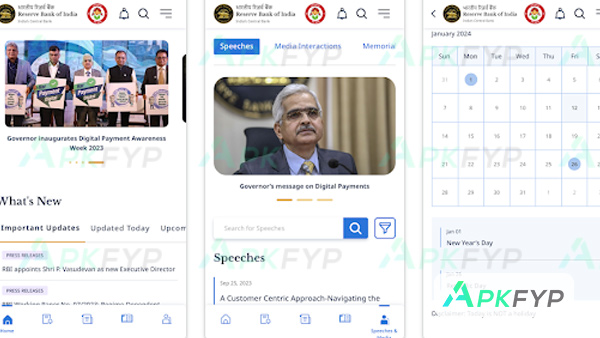

The app provides key financial information like policy rates, exchange rates, and bank holidays, which can help users plan transactions, investments, and budgeting more effectively.

While the app does not offer custom alerts, it allows users to frequently check updated exchange rates to make informed decisions.

No, the app requires an active internet connection to fetch real-time data such as exchange rates, policies, and updates.

You can quickly view a list of national and regional bank holidays within the app, ensuring you never miss important dates for banking transactions.

Yes, RBI Exchange APK provides the latest press releases and monetary policy updates issued by the Reserve Bank of India.

| Name | RBI Exchange |

|---|---|

| Last Version | 1.1 |

| Size | 37 MB |

| Category | Finance |

| Compatible With | Android 5.1+ |

| Last Updated |

Dec 26, 2024 |

| Price | Free |

| Developer | Reserve Bank of India |

| Google Play Link |

GET IT ON

Google Play

|